Stop Buying a Black Box

When you’re buying a company, you already have muscle memory around financial, legal, and commercial diligence.

But the technology that actually runs the business?

Too often, that becomes a shrug and a line in the IC deck: “IT appears adequate.” In practice, that usually means: “We didn’t really look.”

If you’re in private equity, corporate development, or leading an acquisitive healthcare or professional services platform, you know that’s not good enough. IT is where thesis math quietly dies—through surprise capex, dragged-out integrations, and ugly security findings that show up in front of the board, the lender, or the buyer at exit.

IT due diligence is how you see the real asset (or liability) you’re acquiring, not just the one in the deck.

Why IT Due Diligence Matters in M&A and Roll-Ups

Every deal model quietly assumes that IT will:

- Keep running

- Support growth

- Pass future diligence when you eventually sell

But without real IT due diligence, you’re effectively underwriting:

- Unknown technical debt

- Unknown security risk

- Unknown integration cost and timeline

In other words: you’re buying a black box and hoping it behaves.

A Real Example: From “Every Deal Is a Mess” to a Repeatable Platform

One of our healthcare clients has acquired more than a dozen cardiology practices across the U.S.

Before we were involved, every acquisition went like this:

- New practice, new MSP, new vendor stack

- A couple of “Oh, no one mentioned that…” surprises

- Months of cleanup before anyone could talk seriously about standardization

In one target, our assessment uncovered nearly decade-old hardware, unsupported clinical software, insecure physical access to networking gear, and an EMR server sitting under a desk with no real backup strategy. The financials looked fine. The infrastructure behind them didn’t.

Now, IT due diligence is part of the deal model from day one.

We run targeted assessments pre-close, map exactly what they’re inheriting, and fold each practice into a standardized “mothership” environment: common security and compliance controls, a shared vendor stack, and centralized identity, email, and connectivity.

Integrations are quieter. EBITDA is more predictable. And when the next ownership group does their diligence, IT is now a differentiator, not a caveat.

We see the same pattern in other roll-up-heavy models—accounting, legal, and specialty practices. Every office has “their IT person” and “their way of doing things” until someone has to make it all work together.

That’s what “simple, secure, and scalable” looks like in the real world.

What Is IT Due Diligence in M&A?

A lot of IT due diligence is still checkbox work:

“Do they have backups?”

“Is there antivirus?”

That’s not enough for a serious deal team.

When we run diligence, we focus on giving you clear answers to three questions your IC, lender, and future buyer actually care about:

- What is most likely to break in the first 12–18 months?

Aging servers, unsupported applications, single points of failure, key-person risk—anything that can turn into an outage, breach, or forced, unplanned project.

- What will it realistically cost—in capex and opex—to get this environment to a bankable, scalable state?

Not “we’ll modernize IT,” but ranges you can plug into your model, waterfall, and integration plan.

- Can this environment support the growth thesis without a rebuild?

More locations, more providers, more staff, more transactions. Can the current stack handle it, or is your roll-up riding on a brittle foundation?

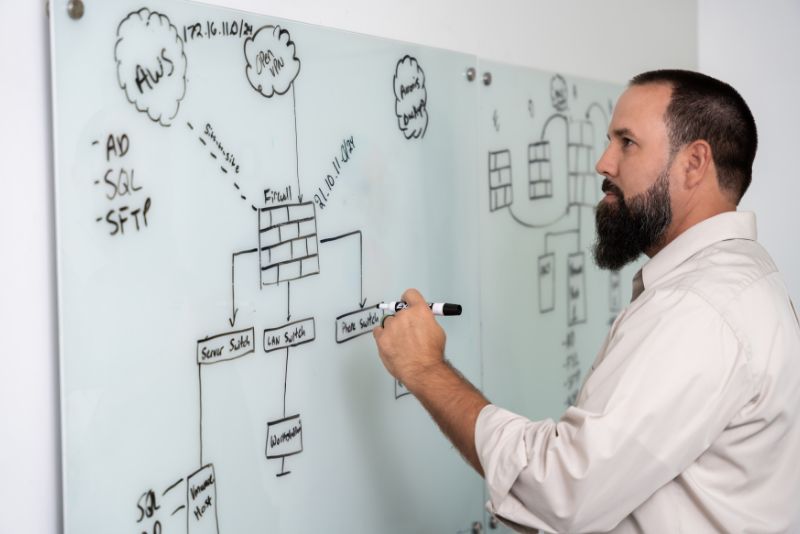

Underneath those questions, we still do the technical blocking and tackling, but always through a deal lens: mapping infrastructure with network discovery and vulnerability scanning, assessing security and access, and reviewing vendors and contracts so you see the full picture—not just the hardware in one office.

The output isn’t a “nerd report.” It’s a business view of IT risk and opportunity your deal team can actually use.

Quick IT Due Diligence Checklist for Deal Teams

If you remember nothing else, remember this: before you sign, you should be able to answer:

- 1. What are the top 3–5 IT failure risks in the first 12–18 months?

- 2. What are the realistic cost ranges (capex + opex) to stabilize and standardize IT?

- 3. Can the current environment safely support the growth thesis, or are you signing up for a rebuild?

If those answers aren’t clear, IT due diligence isn’t done yet.

The Patterns We Keep Seeing (And Pricing In)

Across healthcare, professional services, and other roll-up-heavy spaces, the same landmines keep repeating:

Aging, fragile infrastructure

Production workloads are still running on end-of-life servers or old workstations. Everything “works”—until one failure forces a six-figure emergency project that was nowhere in the model. Our complete network assessments routinely surface forgotten servers, orphaned devices, and unsupported operating systems hiding under the radar.

Backups that don’t actually restore

“Yes, we have backups” turns into “No, we’ve never tested a full restore.” Tapes, USB drives, or misconfigured jobs fail quietly for months. In a breach or outage, this is the difference between a bad week and a board-level incident. Our assessments verify what’s really recoverable—not just what’s configured.

Weak identity and access controls

Shared admin accounts, no MFA for remote access, stale user lists. Perfect entry points for ransomware and data theft, especially in multi-location environments. A cybersecurity assessment shows where protection, patching, and monitoring are missing, and an administrative auditing assessment maps who actually has access to what.

Vendor sprawl

Different MSPs in every location, overlapping tools, unclear SLAs. When something breaks, everyone has a reason it’s not their fault—and all of that becomes your problem post-close. Vendor management is part of our review, so you see where contracts, tools, and responsibilities overlap before you inherit them.

No documentation

“That’s in Jim’s head.” If your environment relies on one or two heroes, you don’t own a stable operation; you own key-person risk. Our administrative audits document user access, renewals, and system policies so nothing critical walks out the door with a single employee.

Every one of these impacts valuation, integration timelines, and your first-year investment plan. The only real question is whether you find them early—when you can adjust terms and expectations—or late, when all you can do is write checks and apologize.

Why a SOC 2 Type 2 MSP Belongs on Your Deal Team

If you’re asking a partner to judge someone else’s controls, their own house should already be in order.

Ours is.

We’re a SOC 2 Type 2 audited MSP/MSSP. That means independent auditors have already spent months testing how we secure, monitor, and operate our own environment—not just reviewing a policy binder on a good day.

For a deal team, that matters because:

- You’re not explaining your IT partner to your board or lender.

When they ask “Who did this work?” and see a SOC 2 Type 2 MSP, the conversation moves on instead of getting stuck on basic credibility.

- You get diligence from people who live under controls themselves.

We don’t just point out missing MFA or sloppy access; we run those controls every day and know what “good” actually looks like in practice.

- Our reports are built to withstand scrutiny.

Evidence, risk scoring, and recommendations are organized so your IC, legal, and compliance teams can challenge them and still walk away comfortable.

Put bluntly: if your IT due diligence partner couldn’t pass an audit on their own operations, you probably shouldn’t attach their report to your deal.

How We Plug Into Your Deal Process

We don’t ask you to bolt on a random “IT workstream.” We line up with how you already run deals and use the same assessment-first approach we use with every client.

- Baseline the platform

We start by understanding the company or platform you’re building on.

That usually means a focused conversation plus a network and security assessment on the platform entity: what’s working, what’s vulnerable, and what needs to change to make IT simple, secure, and scalable. That baseline becomes the standard we measure future targets against.

- Run focused IT due diligence on the target

Once a specific acquisition is in play, we apply the same toolkit to the target environment, tuned to your thesis and timeline:

- Map infrastructure, devices, and users so you know what’s actually in scope

- Assess cybersecurity controls, monitoring, and access so you see real breach and outage risk

- Review admins, permissions, and vendors so you know who has the keys and which contracts you’re inheriting

We roll that into a clear view of what’s likely to break, what it will cost to fix, and whether the current stack can support the growth thesis. The output is built so it can drop straight into your IC materials and lender packages—not just live in a technical appendix no one reads.

- Turn diligence into an integration plan

Post-close, we use the same assessment data to help you fold the acquired company into a “mothership” environment instead of living with one-off fixes at every site.

- Standardize on a common security and compliance baseline

- Simplify vendors and tooling where it makes sense

- Sequence remediation so the most critical risks and bottlenecks are handled in the first 12–24 months

The pattern we’re aiming for is simple: each deal starts with an honest view of IT and ends with systems that are ready to support the next acquisition, not just survive this one.

FAQ: IT Due Diligence with MSG

Do we really need IT due diligence on smaller add-on deals?

If an add-on has its own systems, vendors, or “IT person,” it has the potential to carry real risk—unsupported apps, bad backups, or access issues that become your problem after close. The scope can be lighter on smaller deals, but skipping IT entirely is how you end up with surprise projects and fire drills.

When should we bring MSG into a deal?

Ideally as soon as there’s a serious target—around LOI or shortly after. That gives us time to scope access, run assessments, and feed you findings while there’s still room to adjust valuation, terms, or integration plans.

What if we already have internal IT or an MSP?

Great. We’re not replacing them; we’re giving your deal team an independent, structured view of risk. Internal teams and existing vendors often appreciate having a clear roadmap and an outside voice to help prioritize what to tackle first.

Don’t Sign Blind

You’d never skip financial or legal due diligence. Skipping IT—or treating it as a quick checkbox—is just as risky. The difference is that IT risk tends to show up after close, when your leverage is gone and your reputation is on the line.

If you’ve got an acquisition in motion, or you know another deal is coming in the next 6–12 months, now is the time to get serious about IT due diligence.

- Best next step: Schedule a non-sales consultation to talk through your current deal flow and how you’re handling IT today.

- If you prefer to start smaller: Begin with a free network and technology assessment on your platform company and use that as the template for future targets.

Simple, secure, and scalable IT shouldn’t be a pleasant surprise discovered by your next buyer. It should be part of your thesis from day one. We’ll make sure it is.